late salary payment malaysia

Non-payment of salary is an offence. Basic Allowance Incentive 26 days 8 hours.

Malaysia S Focus On When To Raise Minimum Wage Must Not Forget Why Fulcrum

This scenario actually takes place more often than we know and one such case happened in 2001.

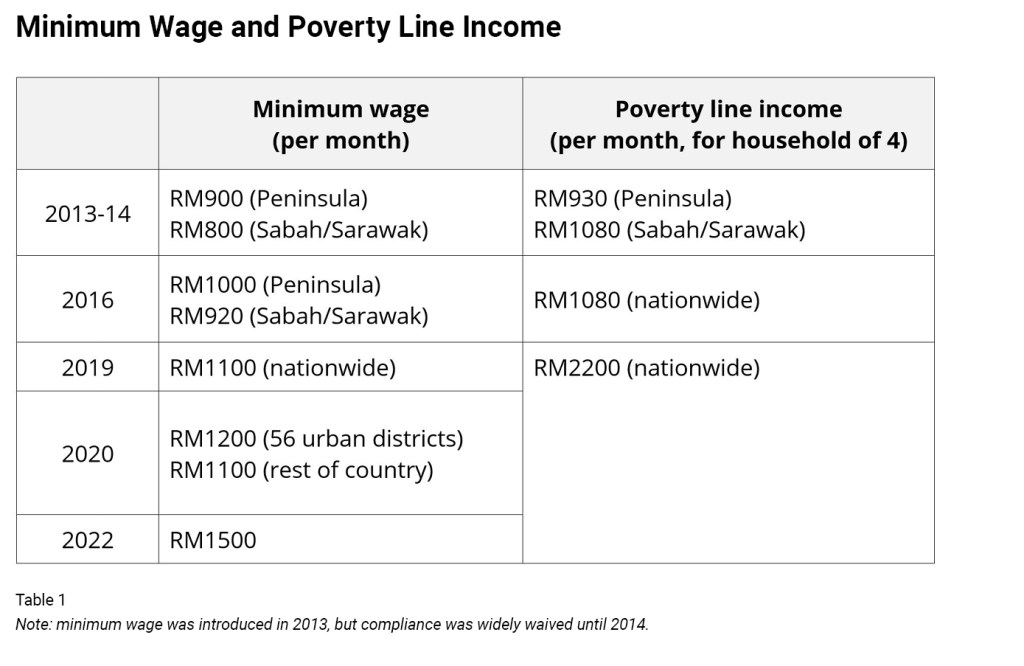

. KUALA LUMPUR April 28 Malaysias new minimum wage rate of RM1500 has been officially gazetted and will take effect nationwide this Sunday which is also Labour Day. Your employer must pay your salary on time according to the terms of your employment contract. A payment into an account at a bank or a finance company licensed under the Banking and Financial Institutions Act 1989 in any part of Malaysia being an account in the name of the employee or an account in the name of the employee jointly with one or more other persons.

From 1 April 2016 employers must keep detailed employment records including salary records of employees covered by the Employment Act. If you are paid late or not paid salary. So to cut their losses a company may deduct the employees salaries instead.

According to the Employment Act 1955 employers are required to payout monthly wages on the seventh day of the following month or earlier. Three months ago gravity payments raised its minimum salary to 70000. An employee weekly rate of pay is 6.

Section 19 of the Employment Act 1955 provides that the Employer shall pay each of his employees within 7 days after the last day of any salary payment period. Meaning that your salary for May 2021 should be paid by 7 th June 2021. RM 5500x 12 calculation by percentage.

Salary Formula as follows. The payment now wont be made until the MD who lives in Germany gets back to the UK later this week so payments will be at least a week late possibly longer. B payment by cheque made payable to or to the order of the employee.

Who are employed and whose country of domicile is outside Malaysia and who enter and stay in Malaysia temporarily under provisions of any written laws relating to immigration. RM 641112 - RM 9670132. In North Malaysia Distributors Sdn Bhd v Ang Cheng Poh 2001 3 ILR 387 the court held that the employers unilateral reduction of an employees salary constituted a significant breach of going to the root of the contract of employment.

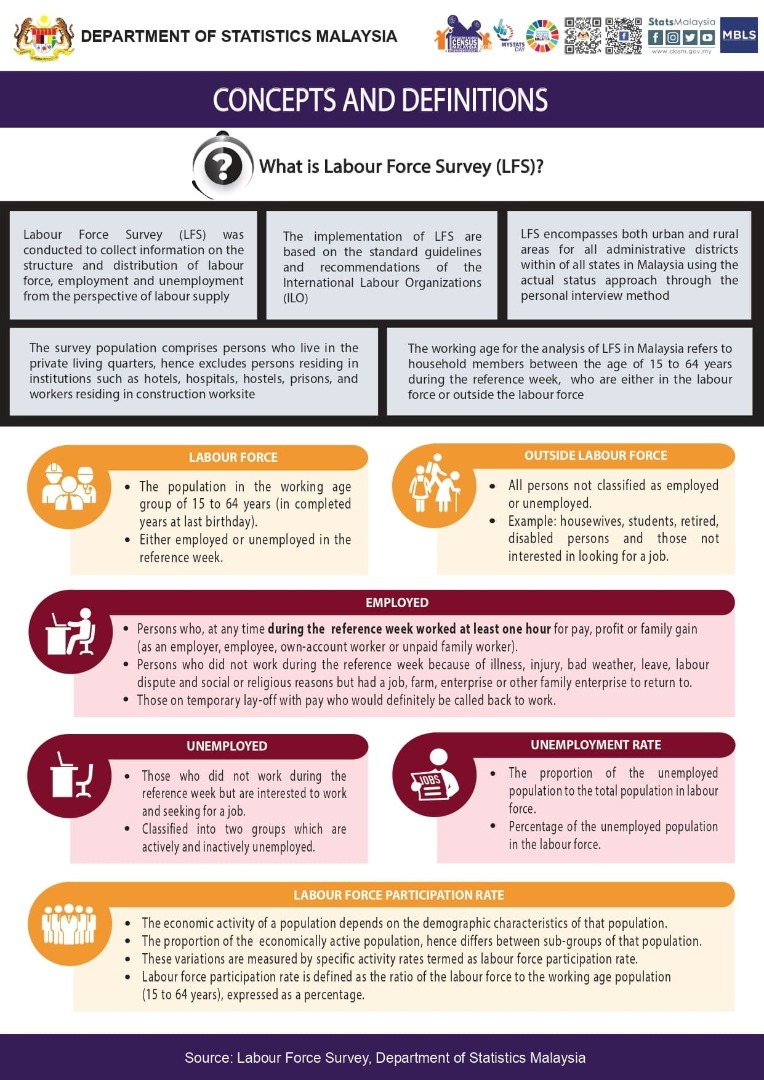

Monthly Salary Number of days employed in the month Number of days in the respective month Overtime rate. How to Perform Salary Calculator Malaysia. Employees aged below 60 years old and earns a salary of less than RM5000.

An employee monthly rate of pay is always fixed to 26. The late payment charge imposed is RM1321 and this must be rounded up to RM14. Not surprisingly all employees finances are based on being paid on a specific date each month and the majority of us will incurr charges or forfeit interest on savings and risk rent.

RM 8500 x 12 refer Third Schedule. JTKSMs labour standards division director Mohd Asri Abd Wahab said the department had received. EPF Employer Contribution.

Although the Employment Act states that the Wage Period is one month. The salary of a chemotherapist. Salary must be paid within 7 days of expiry of wage period you are considered lucky and able to receive your wage late for 10 days.

Employers in Malaysia are reminded that any salary deductions or cuts cannot be done without the employees knowledge or without approval of the Labour Department of Peninsular Malaysia JTKSM as reported in Bernama. The exception is for employers with fewer than five staff members which will only be legally required to start paying at least RM1500 from January next year. Overtime Normal Hours of Work.

RM 1142287 - RM 7497728. In North Malaysia Distributors Sdn Bhd v Ang Cheng Poh 2001 the employers cut the employees pay on the premise that the economy wasnt doing great. Full time EA Employee.

For any overtime work carried out in excess of the normal hours of work EA Employees are to be paid at a rate not less than 15 times his. Below are the available bulk discount rates for. However the Act only covers a number of select employee categories in Malaysia.

RM 5500 x 11 refer Third Schedule. If I still have not received my salary on the 15th of June is the Employer considered late to pay my salary. Paying employee wages late.

RM 6000 RM 2500 RM 8500. Gauthaman who was appointed as operations executive worked for JSAE with a monthly salary of RM3000 with allowances amounting to RM600. Late Salary Payment Malaysia What If An Employer Really Can T Pay During The Mco Period Late Night Laws - Raising minimum salaries and lowering executive pay always sounds great on paper.

RM 392242 - RM 5387802. Many employees in Many other companies in the Whole of Malaysia and Other Countries also Wait to get their salaries late for weeks and. Employees who earn monthly wages of RM2000 or less.

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Termination Of Employment In Malaysia Legal Smart Malaysia

If Your Boss Refuses To Pay You In Malaysia What Can Asklegal My

What To Do When Your Employer Doesn T Pay Your Salary On Time

Guide To Malaysian Employment Law Donovan Ho

Understanding Malaysian Employment Act 1955

How To Build Multiple Sources Of Income And Do It The Easy Way

4 Crucial Payroll Mistakes That Malaysian Employers Must Avoid Althr Blog

What To Do When Your Employer Doesn T Pay Your Salary On Time

Department Of Statistics Malaysia Official Portal

.jpg)

Importance Of Issuing A Payslip In Malaysia Insights Propay Partners

A 2022 Comparison Of Buy Now Pay Later Bnpl Services In Malaysia

A 2022 Comparison Of Buy Now Pay Later Bnpl Services In Malaysia

How To Pay Your Income Tax In Malaysia

A 2022 Comparison Of Buy Now Pay Later Bnpl Services In Malaysia

Individual Income Tax In Malaysia For Expatriates

Guide To Malaysian Employment Law The Malaysian Lawyer

A 2022 Comparison Of Buy Now Pay Later Bnpl Services In Malaysia

No comments for "late salary payment malaysia"

Post a Comment